What You Need to Know About Title Insurance

Frequently Asked Questions

Please see the frequently asked questions about title insurance. Feel free to contact Elite Title Company if you have questions about how our services can help you.

A home is most likely the largest, single investment any of us will ever make. When purchasing a home, you will purchase several types of insurance coverage to protect your home and property. These insurance coverages may include Homeowners and Termite coverage. We remember these well, because we pay them every year.

Unlike other insurance policies, title insurance premiums are charged one time and the policy remains in effect as long as you retain an interest in the property.

Title Insurance, while not as well-understood as other types of insurance, is just as important. When you purchase a home, you are actually purchasing the title to the property which includes all permanent improvements located upon the property. That title may be affected by rights and claims asserted by others which may limit your enjoyment and use of the property. There also may be other claims to the property which may cause large financial losses. Title Insurance protects against these types of title hazards.

An in-house title plant consists of all records filed at the courthouse for each parcel of land, from the very first Deed Conveyance, known as U.S. (Patent), to the current day. Maintaining a title plant in-house can be expensive, so many local title companies choose to buy their research from a competitor, an out-of-state research company, or in some cases an overseas operation. Because Elite strives for perfection and is dedicated to accuracy & efficiency with each transaction, all of our work is produced in-house, distinguishing Elite as the best title company in Northwest Arkansas.

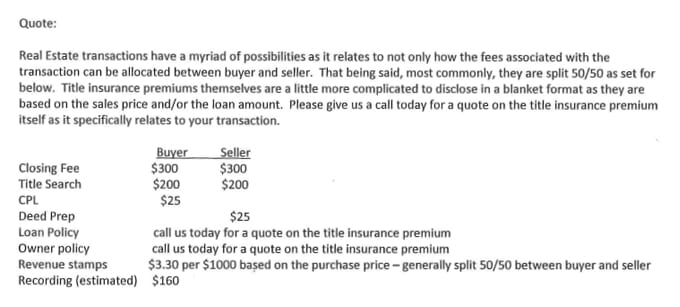

View our basic pricing guide

View our basic pricing guide

Title insurance premiums are based upon the amount of coverage required which will be the sales price and/or loan amount. Many of our competitors use a Good Faith Estimate calculator on their website. For an accurate quote you can depend on, call one of our licensed title agents or you can ask for a ‘quick quote’ by filling out our Online Title Insurance and Closing Order Form or emailing your request to [email protected].

Here are a few of the most common hidden risks:

- False impersonation of the true owner of the property

- Forged deed, releases or wills, Instruments executed under invalid or expired Power of Attorney

- Undisclosed or missing heirs; Mistakes in recording legal documents

- Misinterpretations of wills

- Deeds by minors or by person(s) of unsound mind

- Deeds by persons supposedly single, but in fact married

- Fraud

- Liens for unpaid estate, inheritance, income, gift taxes, and child support

To protect possibly the most important investment you will ever make – the investment in your home. With a Title Insurance Policy, you as Owner, have an indemnity contract that will protect and reimburse you for loss in the event someone asserts a claim against your property that is covered by the policy. A title insurance policy means Peace of Mind in knowing that the investment you’ve made in your home is a safe one. Title Insurance will pay for defending against any lawsuit attacking your title as insured and will either clear up title problems or pay the insured losses.

A title company serves two primary roles in a real estate transaction:

The first role is a title search and examination of the property. A careful search of the public records is made to search documents which may affect the title to the property. These items include mortgages, liens, unpaid taxes, easements, and other restrictions, which may encumber the property. Upon completion of the search and examination of the property, a title insurance commitment is prepared which sets forth the requirements for establishing good and marketable title for the purchaser. The title commitment will also reflect any restrictions or other exceptions which may encumber the property.

The second role is known as the “escrow services.” The title company, through its escrow officers, oversees the closing of the transaction and ensure that all the terms and conditions of the sales contract have been met and satisfied. The title company makes sure that all necessary documents have been properly executed and makes all the appropriate disbursement of funds to ensure that at the completion of the transaction, the buyer receives good and marketable title to the property. In many instances, a lender provides funds to assist the buyer with the purchase price and the title company ensures that it has followed all the closing instructions provided by the lender.

After the closing (now known as “consummation”), the title company will record all necessary documents, forward all payments to any prior lender, County Tax Collector, and pay all parties who performed services or are due funds in connection with the closing.

Title Insurance policies insure titles to real property for owners and mortgage lenders and provide the following protections:

- Payment of loss arising from hidden defects not found during a title examination or recording.

- Payment of legal expenses incurred to clear title defects, which threaten the lender or owner with loss.

- Assurance that the marketability of the property remains unimpaired from title defects.

Policies are issued based upon a search and review of the public land records and other relevant documents. A thorough examination is performed to determine title ownership and any other matters affecting the property title and use of that property. Items that may affect a title include easements, restrictions, rights of way, and judgment liens.

The coverage provided by a title policy is long-lived. The owner's policy exists as long as you own the property, whether it is 5 years or 50. A mortgage policy exists as long as the mortgage is in force.

It usually does, but the lender only requires a loan policy. The lender does NOT arrange for an Owner’s Policy that protects and insures an owner’s interest in the property. You could lose your equity if you do not have an Owner’s Policy.

If I don’t have an owner’s title insurance, how will a claim against my home affect me?

It could be very serious. It would mean you would have to pay all expenses involved with the legal defense of your rights and could even result in complete loss of your equity if your defense is unsuccessful.

It is any one of a number of things that could jeopardize your interest. It could be an unsatisfied mortgage, lien, judgment, or other recorded claim against the property. A defect could also take the form of a claim by a third party such as an unknown heir or prior owner whose title was transferred by forgery or fraud.

Elite Title Company is a full-service title company with headquarters in Springdale, AR. Please contact us today with any other title-related questions you may have!

Some customers prefer Abstract drawing. This service is available by a Board Certified Abstractor. Contact us for your personal drawing.